I have to agree with Shubber that indeed this humble little blog appears to have ruffled some feathers here and there. Some offline criticisms - gleaned via internal e-mail threads passed around among ourselves - indicates we're still not being clear enough in our definitions of what constitutes a "dream" alt.space company, versus that of a "fantasy" or "kool-aid" firm. Allow me a chance to effect some clarification.

Over a year ago, I, my business partner Paul Contursi, and the good "Professor L" on these pages joint-published an article in The Space Review entitled

"The 'signal-to-noise ratio' in financing new space startups". Within that piece were some succinct "gotcha" bullet points making our arguments - what we think of as the "top eight warning signals" of a fantasy or kool-aid enterprise. There are no doubt more...but I'll list the abbreviated version here, and direct you to the original piece for further explanation. You are probably a kool-aid company if you exhibit one or more of the following characteristics:

1.

Unwillingness or inability to identify the team. Most often, a serious space enterprise needs technical experts, managers, financial specialists, marketing people, and other skilled professionals to succeed. That team is essential, and any space entrepreneur who won’t discuss the identity of their team or the skills that its members bring to the table is suspect.

2.

Nebulous funding sources. Be wary of space enterprises that rely on exotic sources of capital that they try to explain away with unintelligible legalese, or, even worse, refuse to specify their sources of capital or guidelines for obtaining it at all. Make sure their fundraising mechanisms are in line with federal and state securities regulations, when necessary, before going any further.

3.

Any combined mention of the words “billion” and “dollars” with a straight face. Startups looking for eight- or nine-figure capitalizations in the currently embryonic state of the commercial space sector are extremely questionable. The reality is that the total private capitalization in the “New Space” companies to date is probably somewhere close to $200–300 million. This is a nascent industry with little to show so far in the way of an overall track record.

4.

Rampant cluelessness about the target market. Constantly ask the questions, “Who are your customers? How much are they willing to pay for your product or service? How do you plan to attract and retain those customers? What are the opportunities for repeat business?” For example, we certainly look forward to the day when solar power satellites are a viable enterprise, but not while customers can easily today acquire electricity at a fourth of the kilowatt/hour rate suggested by the current promoters of space-based systems.

5.

Large quantities of “unobtainium” in the business plan. Dependence upon technologies or exotic materials that do not yet exist is often a sign of trouble. The same is true for speculative propulsion claims that fly in the face of the laws of physics or “get around” the rocket equation.

6.

Dismissal or denial of regulatory considerations. If entrepreneurs dodge the question of how they will deal with the constraints of federal and/or state regulatory requirements they are at best naïve, and at worst might have something serious to hide.

7.

Playing the conspiracy card. Be wary of people who claim that their business plans have been impeded in the past by a grand conspiracy on the part of Big Business, Big Government, etc. “Evil forces” working in the background are far too convenient scapegoats, as opposed to poor planning, unachievable goals, and lack of research.

8.

A tendency for monomania. Be cautious of anyone who tries to convince you that his or her proposed product or service is “the only way” to solve a particular space business or technology problem. Common sense alone suggests that is a false premise.

I hope this sheds some light.

Belated ISDC NotesMy own experiences at ISDC - kool-aid or otherwise - were mixed.

The first presentation I attended was a bit haunting - it was by Klaus Heiss, seeking apparently to purge some personal demons from his own early involvement in development of the Shuttle. At one point, when reminiscing over a key engine decision in the early 70's, the bullet point on the slide said, in bold letters: "I SHOULD HAVE LIED". His belief was had key decisions gone in a different direction, the history of the last 30+ years would have been very different. (He told me later, "The truth is sometimes painful.")

I spent a lot of time in Mike Mealling's business track. There were some very valuable presentations there, including a "seminar" from Art Dula that was a classic, and I highly recommend as a "must-see", if you can get hold of the tape.

But...there was also a guy who wanted $4 Billion to set up mining ops and bases on the moon, along with the ubiquitous lunar mass driver to feed a fuel dump in LEO - the unobtainium, of course, being paid for by an unnamed consortium of 10 large corporations who would kick in $400M each for the development costs. I must admit I snapped like a rubber band at this guy, to the great delight and entertainment of the 6 or so people in attendance that afternoon.

Earlier, I had spent the morning in a track on space medicine, much of which was very enlightening. But then there was the Brit architect who showed off his design for a Mars base, apparently on a grant from the British Interplanetary Society. It had six discrete modules, each simulating a different earthly environment (from the mountains to the prairies to the oceans white with foam, etc. etc.). They would be launched separately, land in the same place, and built-in robotics would assemble them before the first human crews set out. However, there was no thought to actual program planning, costs, or real-world contingencies.

Clearly billions of public dollars would have to be committed to a project like this, and there was no failure factor. So I asked him, "What if one of the modules fails to land properly and is destroyed on impact? Can you make do with 5 or even 4 of the modules and save the mission?" He clearly did not expect a question such as this, and replied nervously, "Well, we just wouldn't launch the crew." $100+ billion project on the line and you just "wouldn't launch". I kept thinking of Robert Scott and the ill fated British Antarctic Expedition, with their stockpiles of sherry and fine china, in contrast to all the things Roald Amundsen did

right, and on half the budget. I wished at that moment Bob Zubrin had been in the room to give the guy an earful. The BIS should ask for its money back.

"If I were a rich man..."I also got 2nd-hand flack at ISDC from some people who were apparently offended and shocked by my assertion that, if serious funding (i.e., $500M+) were raised tomorrow, via a mutual fund mechanism or something similar, that there weren't sufficient investment opportunities in alt.space alone to justify a major commitment of VC dollars. There would have to be serious diversification of investments in technologies 'around the margins' of space to ensure a good return. The criticisms were of the type "He doesn't know what he's talking about - I know how I'D invest...blah-blah-de-blah, huff-huff-huff", followed by a laundry list of either fantasy/kool-aid firms, or firms that may have some customers and an income stream, but whose financial dealings and/or business ethics may be mildly suspect.

Right now, truth be told, I would only put money down on three or four firms if I had it available to me - and I don't recall hearing any of their names on the critic's lists.

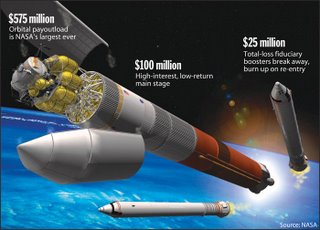

What my critics fail to appreciate is a very important term to those of us who have ever passed a Series 7 exam, and that is "

fiduciary responsibility". When you take

other people's money to invest on their behalf, you become responsible for doing proper due diligence and performing your utmost to give those investors the best possible return in exchange for their trust. This is how investment managers earn their living. And the hard raw truth of it is that there are too few realistic, feet-on-the-ground, alt.space businesses to justify potentially tens of millions in VC dollars. Remember also that VCs

don't pay for R&D - they pay only to get

developed products to market. Also, the supply of investment capital is limited, and therefore very competitive. Alt.spacers need to be able to show a strong value proposition, a path to profitability, and workable exit strategies that are competitive with nanotech, biotech, and alt.energy. It doesn't happen very often.

Now,

if I was independently wealthy, with lots of $$ to burn, and no one to answer to but myself, my standards might be a little more relaxed. I would be able to afford the additional extreme risk levels - but make no mistake, that's considered "angel investment", not VC. There may even be a success or two, by total serendipity. But realistically, I would probably lose most of it in failed ventures. This is why the number of angels and deep-pocket independent startups are limited.

But hey, the critics can always put their own cash where their beliefs are, can't they? And boast to me later about the great returns they're getting. Oh, but that's right, you have to be a "qualified investor". Oops.